crypto tax calculator canada

A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes. You can use crypto as an investment as a currency for spending or as a source of passive income.

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Cryptocurrency is a term that refers to all digital currency but within this term there are many different types of coins and tokens such as.

. Paying taxes on cryptocurrency in Canada doesnt have to be a headache. The Canadian Revenue Agency CRA treats cryptocurrency as a commodity for tax purposes. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

Getting Started is Easy. In Canada cryptocurrency is not considered a. Crypto Tax Calculator.

Home Search results for crypto tax calculator canada How to Calculate Capital Gains on Cryptocurrency. Check out our free and comprehensive guide to crypto taxes. Heres an example of how to calculate the cost basis of your cryptocurrency.

1 416 755-3000 USA Office. For income tax purposes cryptocurrency isRead more. Bitcoin Tax Calculator for Canada.

The adjusted cost base ACB is used to calculate the capital gains. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. Straightforward UI which you get your crypto taxes done in seconds at no cost.

Canadian individual crypto taxpayers are required to use the average cost accounting method for capital gains tax calculations. Simply copy the numbers into your annual tax. You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA.

Cryptocurrency and Bitcoin Taxes. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. The cryptocurrency tax software called BitcoinTax is a crypto tax software that claims to help people with their tax filing for digital currencies.

TurboTax TaxACT and HR Block desktop 1000. However it is important to note that only 50 of your capital gains are taxable. Report crypto on your taxes easily using Koinly a crypto tax calculator and software.

Similarly your crypto taxes for the 2022 financial year must be filed by the 30th of April 2023. And for US residents these are the most important forms that your calculator should support. Bitcoin Litecoin Ripple Pokadot Ethereum etc.

The resulting number is your cost basis 10000 1000 10. Calculate and report your crypto tax for free now. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes.

Guide for cryptocurrency users and tax professionals. Download Schedule D Form 8949 US only Reports and software imports eg. BitcoinTax is a cryptocurrency tax software which has been launched for US citizens but it can be used by Canadians as well.

Crypto taxes in Canada are confusing because there are so many use cases for crypto. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada.

By sdg team Tax. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. Each of these is accounted for and valued as a separate asset.

This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. For the amount of work Im doing I might as well do it all myself. I mostly just use Koinly to find the market values at the time of my transactions and to have the value of my portfolio on my phone using the Android app.

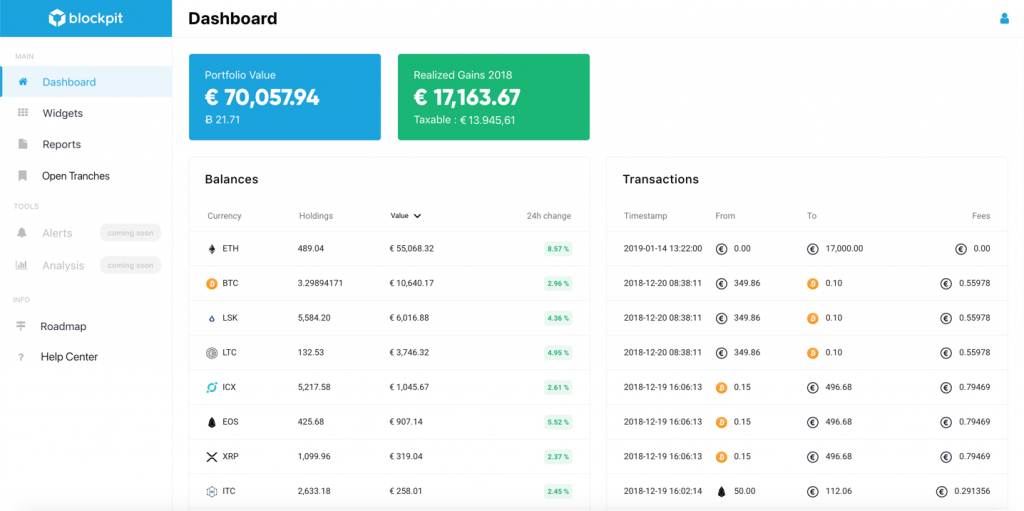

Adjusted cost base ACB Canada Share pool United Kingdom. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you can print tax reports including an income report capital gains report and a buysell report. Take the initial investment amount lets assume it is 1000.

File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada. Generate complete tax reports for mining staking airdrops forks and other forms of income. The tax return for 2021 needs to be filed by the 30th of April 2022.

Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD. Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how.

Whatever method you use make sure you double check that everything is being calculated correctly. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax calculators and talk in-depth about crypto taxing. Ad Join the New Digital Economy with TradeStation Crypto to Learn About Invest in Crypto.

By the time you buy your new car however Bitcoin has collapsed and you sell your holdings for. When it comes to Income Tax youll take the fair market value of the crypto in CAD on the day you received it and apply your Federal and Provincial Income Tax rates to the entire amount to calculate how much Income Tax youll pay. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the. A simple way to calculate this is to add up all your capital gains and then divide this by 2. As another example suppose you sell that Ethereum for 4000 in Bitcoin and then use that 4000 of Bitcoin to buy a new car.

Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. 2 Bloor West Suite 1900 Toronto ON M4W 3E2 Canada. Adjusted cost basis and superficial losses Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs.

Mining staking income. The source data comes from a set of trade logs which are provided by the exchanges. Automated Crypto Trading With Haru.

This means that any income you receive from transactions involving cryptocurrency is treated either as business income or as a capital gaindepending on whether or not you are operating as a business or simply as a hobby. More specifically the CRA states that the ACB is the cost of property and that in the case of identical properties you use the average cost of each property to determine your adjusted cost basis. You can find your Federal and Provincial Income Tax rates in the tables above.

Fund Your Account and Start Trading Cryptocurrencies Today. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

Pin On Income Tax Calculators Net Income Calculators

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Best Crypto Tax Software 10 Best Solutions For 2022

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Capital Gains Tax Calculator Ey Global

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Calculate Your Crypto Taxes With Ease Koinly

Altcoin Calculator 1 000 Crypto 31 Fiat Currencies Script Website Fiat